Companies issue shares of stock when they want, or need, to raise money; so why would companies buy back stock? The answer seems like it should be obvious; they have too much money. For some companies, this might be true; but there are other reasons companies repurchase shares. In this article, we're going to talk about stock buybacks. As part of that discussion, we will review the reasons a company might decide to repurchase shares of stock. Next, we'll explain why a company might deploy this tactic instead of paying dividends. Then we will finish up with the pros and cons of these programs.

Buying Back Stock

Most companies look to expand their businesses by spending money. They invest in new plant, machinery, or perhaps even a new advertising campaign. Well-run companies will only spend money to make more money. They have new ideas, products, or services they wish to sell. To increase earnings, they need to invest even more money in the company. When companies run out of profitable ways to reinvest net income, then they can either return the money to investors in the form of dividends, hold onto the cash in the form of retained earnings, or they can repurchase shares of stock. This is exactly what happens to some very large and profitable companies when they find themselves with too much cash on hand. But there are other reasons a company might decide to buy back shares.

Undervalued Companies

Management of the company may also decide to repurchase shares if they believe the market price of their stock is too low. For example, the board of directors of a company may choose to authorize a repurchase at a price that is no higher than 110% of the book value per share. When a company makes this type of announcement, it is sending the market a message. It's telling investors it believes its shares are undervalued, and if the price drops below a certain threshold, it's going to buy those shares at bargain prices. This is exactly what Berkshire Hathaway did back in September 2011.

Increasing Earnings per Share

Executives might also buy back stock to increase earnings per share (EPS). This is typically frowned upon, since the managers of many companies are often compensated based on the performance of financial metrics such as earnings per share. When a company has the opportunity to reduce the number of shares outstanding, and the program does not affect profits, then earnings per share will rise.

Investors need to be cautious about investing in a company that is reducing the number of shares outstanding merely to inflate their EPS. While an increase in EPS normally indicates expanding profitability, the corresponding decrease in shares issued may warn of a shrinking outlook.

Reduce Takeover Risk

As companies accumulate cash, they become attractive takeover targets. That's because when one company buys another, the acquiring company can use the cash held by the target company to help offset the cost of the takeover. This topic is discussed more thoroughly in our article: Identifying Takeover Targets. When a company purchases stock on the open market it reduces the amount of cash on hand, thereby reducing the risk of being classified as a takeover target.

Debt-to-Equity Adjustments

Companies are always examining the amount of leverage they're using. Generally, the cost of debt might be half that of equity. While the overuse of debt is problematic, there are times when it might be desirable to replace equity with debt. In doing so, the company would sell bonds, and use the cash generated to buy shares of its stock.

Reducing Dilution

Generous employee stock option plans increase the number of shares outstanding when those options are exercised. This increase, or dilution of shares, lowers key financial ratios such as earnings per share. When that occurs, the financial position of the company appears to be more fragile. By repurchasing shares of stock, a company can reduce the effect employee stock option plans have on the number of total shares outstanding.

Buybacks versus Dividends

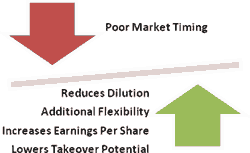

The payment of dividends to shareholders is usually a long-term commitment. Once a level of dividends is established, a reduction in that level would normally be a sign of trouble. A company faced with a choice to increase dividends, or repurchase shares, would base their decision on the long-term sustainability of the source of excess cash. For example, if the company were to sell a subsidiary for a sizable profit, they might find themselves with a large accumulation of cash on hand. Since this is a one-time event, using the cash to pay dividends is not sustainable over the long haul. Repurchasing shares also offers the company's management greater flexibility than dividends, since it's possible to terminate, or suspend, a buyback program.

Tax Implications

There is an ongoing debate concerning the benefits of repurchase programs versus paying dividends. A company's earnings are taxed, and dividends are taxed again when received by investors. Buying stock should increase the value of the shares still held by investors. This is one of the reasons some investors believe buybacks are better than dividends. Unfortunately, the only way to reap the benefit of this increase in value of the stock is to sell it. The investor would then have to claim a long or short term capital gain on their federal income tax form. In the end, it is unlikely that a buyback offers an investor any long term tax advantage versus a dividend payout.

Buyback Announcements

Traditionally, the approach to these programs takes one of two forms:

Open Market: in the same way investors purchase shares of stock, a company can choose to purchase shares of its own stock on the open market.

Exchange Offers: also referred to as a tender offer, shareholders are presented with an offer from the company to "tender" all, or a portion, of their shares in a given timeframe. The repurchase price is usually at a premium to the prevailing market price per share.

Advantages and Disadvantages

The investor's view of the advantages of a stock repurchase plan will be similar to that of the company's management team. These advantages include:

Flexibility: unlike dividends, these programs can be terminated or suspended.

Reduced Dilution: buybacks will counteract some, or all, of the negative effects of generous employee stock option plans.

Earnings per Share: as the number of shares of stock is reduced, the earnings per share rise, effectively increasing the profitability of each share.

Takeovers: companies with a lot of cash on hand are deemed to be more attractive takeover targets since the cash can be used to help fund the takeover.

The primary disadvantage of these programs is something many investors have experienced before:

Timing the Market: investors familiar with the random walk theory may have already guessed at the big disadvantage of these programs: They are impossible to time. Companies run the risk of repurchasing shares at relatively high prices, only to wind up reselling those shares later on at a lower price; when additional capital is needed to fuel growth.

About the Author - Stock Buybacks

.jpg)

.jpg)