Truthfully, this title should actually be “How to Make a Million Dollars in 10 Years Without Going Into Debt", but that is just getting a little too winded for my liking. It’s true though!

My girlfriend and I worked out how this can be done on a sketch pad while we were watching the sunset (which, by the way, is the best place for working on your finances if there ever was one).

Here is how we figure we could earn a million bucks within just 10 years. And, more importantly, how YOU can earn a million bucks in just 10 years.

Step 1: You Must Be Debt Free

If you want to make a million dollars in 10 years (the low-risk way), it really helps to be debt-free. I have many friends who have a nice car, a nice house, and fancy furniture, which basically means that they have a lot of debt. Because of all that debt, they are obligated to make those big monthly payments, which keeps them from earning thousands, let alone millions.

If you can free yourself from the grips of all those debt payments, your cash flow will grow to a massive amount each month. And, with that cash flow you can begin to invest heavily and earn yourself that million dollars.

Say Goodbye to Debt with the Snowball Method

The debt snowball is a proven way to pay off your debts faster and cheaper. With our handy spreadsheet, you can easily track your progress toward freedom from debt! Download the template for Excel or Google Sheets to easily create a custom repayment plan.

Step 2: You Must Live on Less

I always thought that I lived very frugally, but just recently I have discovered that I was dead wrong. Only after I started budgeting did I realize just how much money I was throwing out the window!

My cell phone bill used to be $85 a month. By negotiating with Verizon, I got this reduced to only $60. My car insurance used to be $960 a year. By shopping around, I was able to find a company that would insure my car for only $575!

I was also able to reduce my grocery bill by eating out less and buying less expensive foods (while still staying healthy). The list goes on and on, but overall I was able to save another thousand dollars each year! Plus, I discovered that I could live on only $460 a month!

A thousand bucks is quite a lot of money, but since I saved it instead of earned it, it’s more like $2,000. You see, when you earn more money, you end up paying a crap-load of taxes on those earnings. In the end, your $1,000 of earned money turns into something close to $500. Therefore, if you save $1,000, you have effectively done the same thing as getting a $2,000 raise at work! Isn’t that awesome?

Cut Spending with a Budget

Our budgeting spreadsheet will help you keep track of your spending and see where you can save. It will even show you what the ideal budget is for your income! Download the template for Excel or Google Sheets to take control of your finances today!

Step 3: You Must Earn More

If you want to make a million dollars in a short amount of time, then it would really help to earn more than $40,000 a year. Sure, saving is a great way to increase your cash flow each month, but you can only save so much before putting yourself into a state of poverty. At this point, you need to think about earning more money. And, since many of us work a job that pays a salary, this is the best place to start to earn more money.

If you want to move up at work and earn a few extra thousand dollars (or more) a year, then you had better start impressing your boss. Here are some great ways to get noticed at work and earn that promotion:

Dress as if you already got a promotion

Take the lead on large projects

Earn your company far more than they pay you

After a year of hard work, show on paper why you are worth more than what you are getting paid, and most importantly, ASK FOR A RAISE!

You can also increase your income by working a 2nd job or starting your own small business on the side. Four years ago, I decided to start writing this kind of web content, and it now earns me a sufficient amount of money each month in addition to my full-time job.

By earning more at work (and perhaps through another avenue) and keeping your living expenses low, your cash flow should be enormous! In just a few months, I will have my house paid off and will enjoy a surplus of $3,500 a month! In just one short year, I could have $40,000 chilling in my bank account, just waiting to be invested! If I can do it, why can’t you?

Step 4: Find a Bargain on Real Estate, Fix It Up, and Rent It Out

There are plenty of ways to get wealthy: your side business could take off, you could invest your money perfectly in the stock market, or you could invest in the ideas of others and get paid back in large royalties. But, the best way to get wealthy that I know of is with real estate.

Three years ago, I bought my first house. I paid $75,000 for it, put another $10,000 into it and fixed it up myself, and today my home is worth over $120,000! Over a short period of time, I was able to amass a $35,000 gain by ripping off some wallpaper and slapping up some paint! Now the question is, what if I was able to do this to another house, and also rent it out for additional earnings? The income potential is limitless!

In my area, I could find a cash-only deal on a house for about $60,000. The fix-up costs would at most be $5,000 because I could do much of the work myself. After the DIY projects were completed, I could rent out this home for $900 a month (which, by the way, would increase my income and allow me to make the next purchase in less time than the first one).

Step 5: Repeat Step Four Again and Again

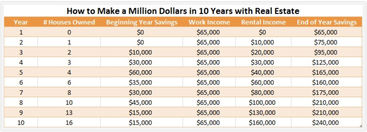

It’s time to get into the nitty-gritty. Is it really possible to make a million dollars in real estate in just 10 years? Of course it is! But let me prove it to you.

Because my girlfriend and I are quite frugal and have absolutely no debt, we can fairly easily amass $65,000 of extra cash in one year.

Before you scoff at that and say, “Well then of course you can earn a million in ten years! Nobody else has the kind of income that can produce an extra $65,000 a year!”, remember that we already went through steps one through three.

If we had not gotten rid of all of our debts, reduced our spending to practically nothing, or worked hard specifically to achieve raises at work, then we would only have an extra thousand bucks a year like the rest of America.

I don’t mean to be harsh, but that is the blunt truth of the situation. Follow steps one through three and you will notice a HUGE increase in your cash flow as well.

May I continue now? Thanks, I will.

Alright, so if you follow the steps outlined here, then you too could save up to $65,000 a year! Once you get to this point, here is the process to amass your millions:

Year 1 is spent working hard, taking cheap camping vacations, and eating many meals at home (instead of at the pricey restaurant). After the first year, you will have your $65,000 to invest in your first rental house with CASH!

Year 2: You continue working hard at your day jobs, you fix up the house in the evenings and you rent it out to a kind family in need of a home. Your net earnings on this investment are just over $800 a month, which equates to $10,000 a year (the earnings are pretty hefty when you don’t have to pay a mortgage on that rental property). After this year is over, you and your spouse have saved up $75,000 ($65k + $10k).

Year 3: You have the money to buy another rental property for $65,000, so you fix it up and rent it out. It also earns an extra $10,000 per year. At the end of this year, you have 2 rental properties and $95,000 ($10k left over from last year + $65k + $10k + $10k).

Since the math is getting a little messy, let’s shift over to table form:

Year 4: You buy another house, rent it out, and develop savings of $95,000

Year 5: You buy another house, rent it out, and are able to save up $125,000 by the end of the year

Year 6: You have enough in savings to buy 2 houses! Your rental income has now soared to $60,000 per year, which allows you to buy 2 houses per year consistently!

Year 7: You buy another 2 houses, rent them out, and develop a savings of $175,000 by the end of the year

Year 8: You buy another 2 houses, rent them out, and save up $210,000 at year end.

Year 9: With your large savings, you are able to buy 3 rental houses this year! Even after those purchases, you are still able to amass $210,000 in your savings account.

Year 10: In the tenth year of this madness, you can purchase another 3 rental properties, which gives you a total of 16 houses.

Adding It All Up

Assuming that each house has an average value of $100,000 (after you have fixed them up), your 16 houses have amassed a value of $1,600,000! And, as if that isn’t enough, they are earning you $160,000 per year (not including the rising house values year after year)! At this point, if you and your spouse wanted to quit your jobs, I’d say you wouldn’t even have to think twice about it.

So, it looks like I actually overachieved and found a way to earn you $1.6 million in 10 years, not $1 million. Oops. But, since everything in life doesn’t always work perfectly to plan, you might “only” earn the million instead. It’s always good to have a buffer in your plans, right?

For me, this plan is pretty cut and dry, and pretty simple to boot. All you have to do is find one deal on a house each year, fix it up, rent it out, and then repeat the process again and again. By working with cash, your headaches with the bank are minimal and your profit margins on your investments are massive!

So what do you think? Would you sign up for this plan to make a million dollars?

.jpg)

.jpg)